Do you want to reach stunning results on Forex? Then read our article "How to Trade Forex with $100 for any Trader". You will learn more details about the rules for successful forex trading,

In this article, we will share methods on how to make your trading more efficient and profitable so that you can be really proud of your accomplishments.

How to trade Forex

For traders, Forex is a place where they can yield profit from fluctuations in a currency value. A currency pair is a price quote of the exchange rate for two different currencies traded on Forex.

Speculators receive a profit from the difference in their quotes.

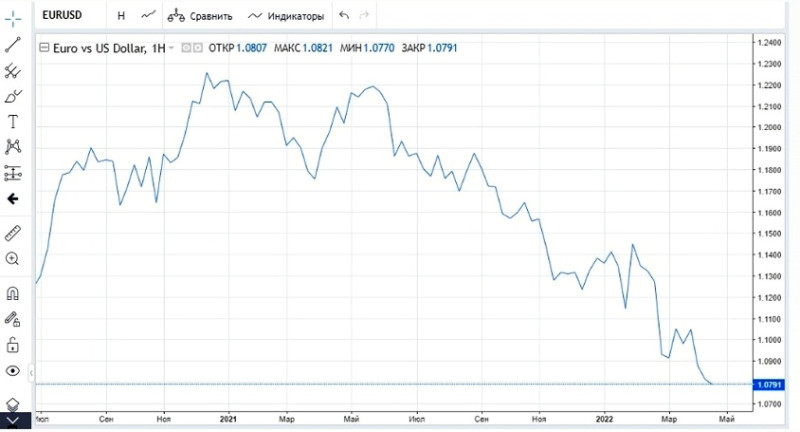

The most popular FX currencies are the US dollar and the euro, which are quoted against most other currencies. This is why their liquidity is always high. The EUR/USD pair is the most liquid forex pair in the world.

Let’s assume that a trader chooses this pair, anticipating the euro to rise versus the US dollar. A trader opens a long position to buy EUR for USD at the current exchange rate, hoping that the asset will climb in price.

If the forecast is accurate, a trader makes a profit by closing the position and selling the euro at a higher price. A trader also gets more dollars than he initially bought.

If the price moves in the opposite direction to the forecast, the trade becomes unprofitable.

Here is an example.

Let's say, the EUR/USD pair is trading at 1.0795. To open a long position on one euro, you will need $1.0795.

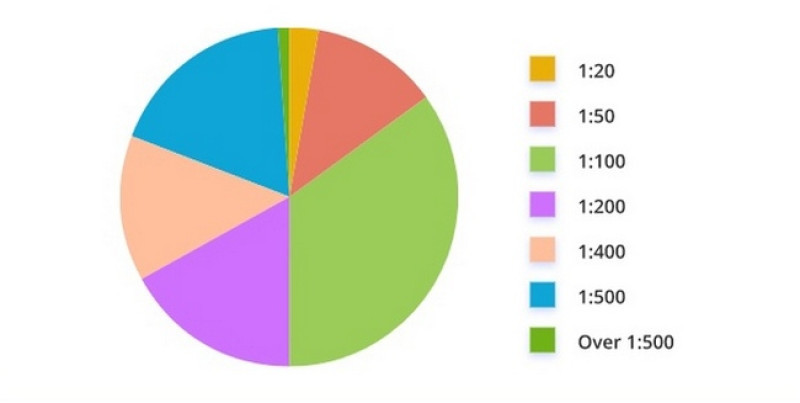

You have $100 in your account. You choose leverage of 1:100 and open a trade with a lot size of $10,000.

Four hours have passed, and the rate, as you expected, has advanced. Let's say, to the level of 1.0895, that is, by 100 pips.

After selling the euro at the new exchange rate, your profit, taking into account the broker's commission, will total approximately $90.

However, if the exchange rate started moving in the opposite direction, you would lose the lion's share of your deposit.

Thus, forex trading is risky. For this reason, do not put all your money into one trade.

How to make trading more efficient

Constant luck is a rare thing on Forex. As a rule, profitable trades are followed by highly lucrative ones. The main thing is that there are more extremely profitable ones.

However, what if the losing streak does not end? Experienced traders share their experience on this matter.

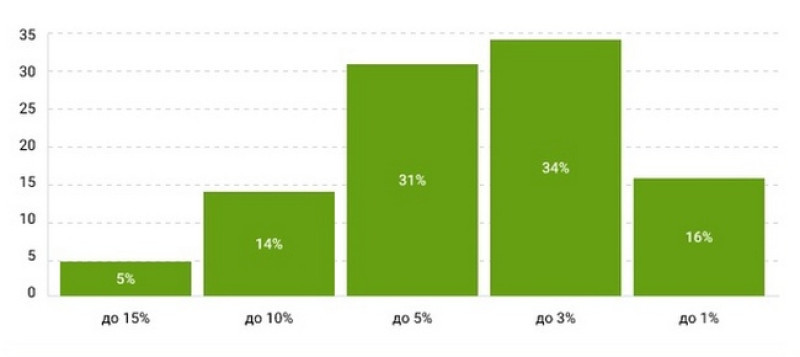

Firstly, in their opinion, traders need to be always prepared for ups and downs. They should not expect that their initial capital will increase significantly in a month of trading.

It will be extremely good if it rises by 5-15% per month.

When trading Forex, you need to set realistic goals. Oftentimes, optimists are too afraid of not living up to their hopes, while pessimists may give up trading at the first failure.

Secondly, the psychological factor plays an important role. Make sure than you balance your emotions and only after that start trading.

Otherwise, you are likely to make harsh decisions due to anger, irritability, or anxiety.

Thirdly, it is important to keep the situation under control. Do not open a trade if the risk is higher than 2-5% and do not put all your money in it.

Last but not least, don't stop learning and developing trading skills. It is better to learn as much as possible rather than remain ignorant.

How to Improve Trading Skills?

This question is more relevant to those traders who are making their first steps on Forex. As a rule, novice speculators expect to hit the jackpot in the shortest period of time.

Experienced traders are well aware that it is crucial to start trading carefully, gradually increasing the capital. Stories about instant success and big money at the start are just a smart advertising move.

We will outline the basic rules that help beginners avoid excessive losses and increase the efficiency of trading.

First and foremost, you should find a reliable broker. Do not choose lightheartedly. Pay attention to the reputation and reliability of the intermediary that builds the bridge between you and the market.

- It is equally important to study the trading conditions of a broker:

- Commission;

- Deposit and withdrawal methods;

- List of trading instruments;

- Leverage limits;

- Bonus programs.

2. Decide on a trading strategy. If you are aiming for short-term trades, choose scalping or intraday trading. If you plan to hold positions for several days, swing trading will be a better option.

Whichever strategy you choose, you should practice it on a demo account.

3. Use a small deposit. According to experts, a deposit of $ 500-1,000 will be enough to make the first steps on Forex;

4. Don't start with aggressive trading. This approach is applied to get the maximum profit in a short period of time.

Aggressive traders recognize possible risks and invest all the money from the deposit into a position. Yes, the chances of profit increase as well as the chances of potential losses.

That is why it is better for beginners to stick to conservative strategies.

5. Don't take too much leverage. Beginners are recommended to use this tool only if they are confident in the profitability of their trade.

If you want to take a risk, maximum leverage that a novice trader can afford is 1:50. The optimal option is 1:10 or 1:15.

Now let's move on to the trading recommendations. They will be useful for both beginners and professional traders.

First of all, you should clearly understand when you should enter the market and when it is necessary to close a position. As a rule, it is better to trade along the trend but some market participants prefer to trade against it.

Remember that you need to open positions according to the chosen strategy.

Let's say you see the head and shoulders pattern on the chart, which indicates a trend reversal. If the pattern is pointed upwards, a trader opens a short position.

If the head and shoulders are pointed downwards, an uptrend may take place. The asset will rise in price. For this reason, a trader should open a long position.

You need to close positions taking into account your strategy as well. Whichever method you use, the exit implies a high ratio of profitability and risk.

Don’t forget about stop-loss orders. It may help you evade excessive losses as it closes all positions in a trade when the maximum allowed loss in that position is reached.

When placing a stop-loss order, it is important to consider two factors.

The first factor is that the order should be placed at the level where the trade will be closed if something goes wrong. For example, if you open a buy position, a stop-loss order is placed where it will not affect the trade.

The second factor is the ratio of possible profit and risk. The most optimal option is 2:1, that is, when every two pips of profit correlate with one pip of loss.

Let's say you can gain 100 pips after the breakout. In this case, it is better to set the stop-loss at 50 pips from the entry point.

Many traders stick to the rule to never risk more than 2% when placing a stop-loss order. In other words, you should never risk more than 2% of your account balance on any trade.

No matter how experienced you are, the analysis of completed trades can increase the efficiency of trading. You should primarily focus on trades that have brought losses.

By determining certain areas on the chart, you will be able to identify which of your actions led to a negative result.

For example, when using the Pin Bar strategy, you may incur losses when the signal appears simultaneously with Inside Bar. As a result, an Inside Pin Bar is formed.

As mentioned above, a speculator should enter Forex after choosing a certain strategy. Without a strategy, trading will be chaotic and fruitless.

However, it does not mean that you should strictly adhere to the strategy you picked some time ago forever. It is important to stay flexible and adjust the strategy taking into account changes in the market.

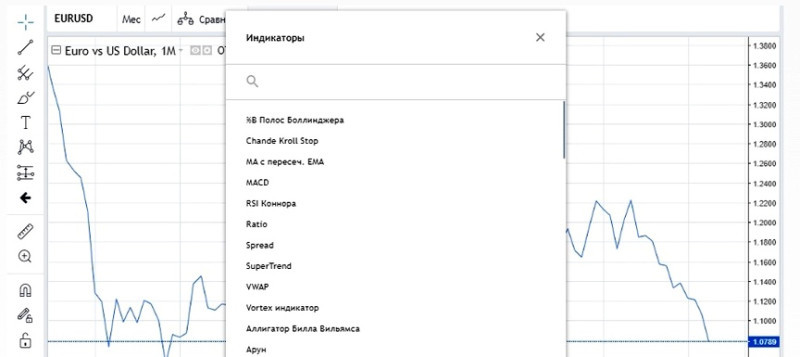

Finally, let's talk about the trading indicators. There is a great array of them. Some traders, especially beginners, want to apply them all at once.

Let's assume that according to your trading strategy, you need to open a position when a pin bar is formed. You decid to apply the stochastic indicator as well. After looking at the trading of experienced speculators, you add the Fibonacci levels.

As a result, it is simply impossible to read the chart. Therefore, every trader should choose the most suitable indicators and use them.

If you use many indicators at the same time, it does not mean that you have perfect technical analysis skills. The rule- the more, the better - doesn't work in trading. The use of several indicators and oscillators will be quite sufficient.

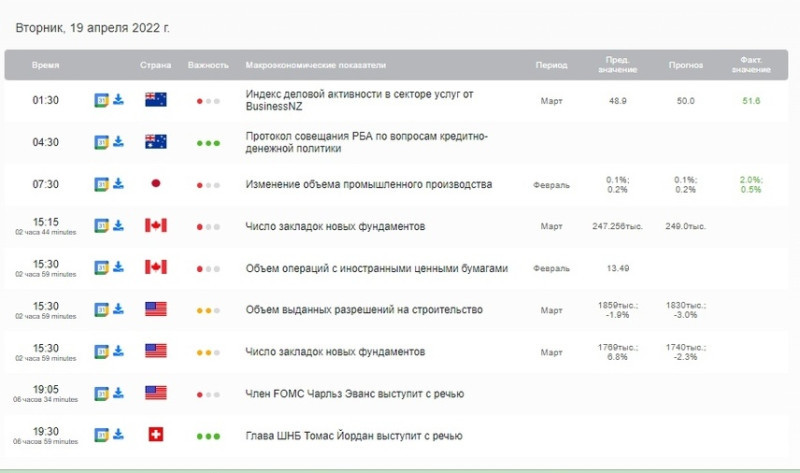

It is also recommended to track the events in the economic calendar, which is of great importance for those who use fundamental analysis.

In the economic calendar, you can find out when crucial macro stats are on tap. Crucial economic reports set market trends.

We have talked about the main trading methods that will make your trading more efficient. There are also several more steps that will reduce trading risks and thereby losses.

Here are other ways to boost your trading results:

- choose another brokerage company. This is an extreme measure. However, if you see that the broker you have chosen charges higher fees than others, it is the reason to think about a new broker.

Do not forget that less experienced and time-tested companies can offer more attractive commissions. Make sure they have a license and at least five years of experience; - change the trading time. Forex works around the clock five days a week.

And if, for example, intraday trading does not bring the desired profit, you can try your hand at overnight trading; - use the Rebate service. By using this service, you can count on a refund of part of the commission.

Forex trading during economic crisis

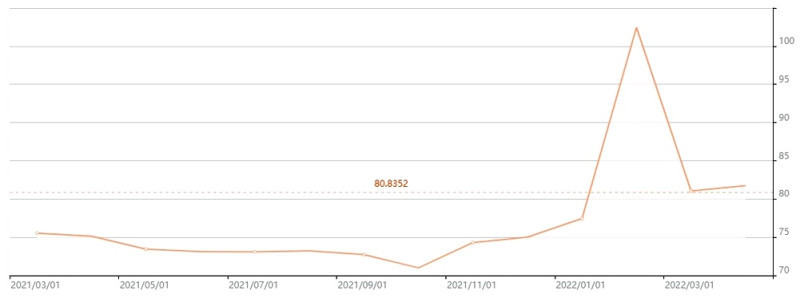

Recently, the media has been reporting non-stop about the deterioration of the global economy as well as the economies of some states. The current crisis caused by the consequences of the coronavirus pandemic and the milirary conflict in Ukraine is not the first and definitely not the last one.

It has always been so. Periods of rapid growth are followed by periods of economic decline.

Economic uncertainty also affects the exchange rates of currencies. Traders who are closely monitoring their sharp jumps may even ask themselves: is it worth trading Forex during a crisis?

The answer is yes. During a crisis, traders can yield higher profits from invested money as well as improve trading results.

Many speculators have noticed how drastically the Russian ruble weakened against the US currency after the start of the military conflict between Ukraine and Russia. High volatility, as you know, is the best time to open positions.

Thus, by choosing the currency pair that is most impacted by the crisis, you can make decent money on fluctuations in the exchange rate.

Conclusion

To sum up, it is possible and even necessary to improve trading skills. To do so, you need:

- hone your skills;

- strive to learn something new;

- evaluate risks;

- try not to put all your money in one position;

- trade only one currency pair at the start;

- stick to the strategy and analyze mistakes.

At the same time, you should understand that forex trading is not a hobby but hard work. To make a solid profit, you need far more than pure luck.

However, opportunities in the foreign exchange market are limitless. It means that with a reasonable approach, your time and effort will surely bear fruit.

Read more:

Back to articles

Back to articles