The EUR/USD currency pair showed no interesting movements throughout Monday. In fact, the pair has been in a complete flat for six months, so it's not surprising that there was no volatility or traders on the market on December 29. The US currency has been gradually appreciating over the past few days; however, this increase is so minimal that it can be considered mere market noise. Moreover, all movements over the last six months could also be seen as market noise since the price has been primarily influenced by technical factors while largely ignoring fundamental and macroeconomic factors.

Essentially, the dollar is currently clinging to 1.1800. This level represents the upper line of the lateral channel at 1.1430-1.1800 on the daily timeframe. As long as the price remains below this level, at least a flat trend is maintained. This level is a lifeline for the dollar. The fact that the dollar had no reason to grow was evident even in December. What positive information did we receive from the US in December? The only thing that comes to mind is the GDP report, which has already been heavily criticized even by those analysts who occasionally praise the dollar.

It has become evident that the American economy's growth is entirely artificial. Explain how an economy can grow when the unemployment rate is rising, people are losing jobs, very few new jobs are being created, industrial production is hardly increasing, retail sales are stagnant, and business activity is declining in most cases.

We have already mentioned that Trump is not concerned about inflation levels. Even if inflation reaches 10%, as long as the economy is growing steadily, the US president would find this acceptable. What matters to Trump is having a solid reason to inform the American people about unprecedented growth. Whether this growth is merely "on paper" is irrelevant. Recall what Trump has said about potential increases in inflation? He believes that most Americans won't notice it, as they'll be "busy counting money in their wallets." After all, with a growing economy, every American should be earning significantly more. However, as we can see, prices in the US are increasing, while Americans are increasingly losing jobs or facing cuts to subsidies and support as Trump seeks to save the budget.

Thus, we have a situation where the American GDP is ostensibly growing at near-record rates, but in practice, such growth is not desired by anyone. Hence, the dollar hasn't seen a surge of optimism, and the market isn't eager to buy the American currency. We are still awaiting the breakout of the upper line of the lateral channel and the resumption of the global uptrend in 2025.

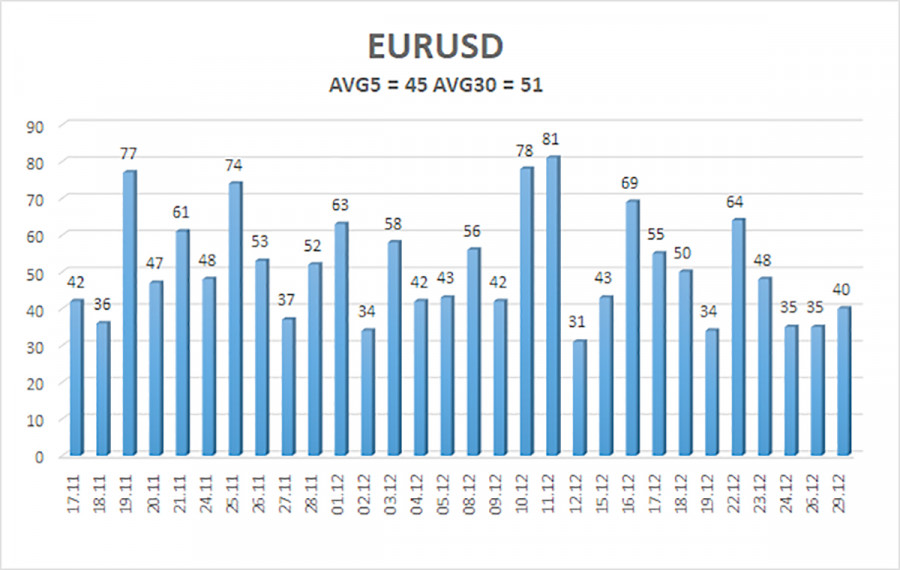

The average volatility of the EUR/USD currency pair over the last five trading days as of December 30 stands at 45 pips and is characterized as "low." We expect the pair to trade between 1.1709 and 1.1799 on Tuesday. The upper channel of the linear regression is turning upwards, but the flat trend continues on the daily timeframe. The CCI indicator has entered the oversold area twice in October and visited the overbought area at the beginning of December. A slight pullback has already been observed.

Nearest Support Levels:

- S1 – 1.1719

- S2 – 1.1658

- S3 – 1.1597

Nearest Resistance Levels:

Trading Recommendations:

The EUR/USD pair is above the moving average line, with an uptrend maintained across all higher timeframes, while the daily timeframe has been flat for the sixth consecutive month. The global fundamental backdrop remains highly significant for the market and remains negative for the dollar. Over the past six months, the dollar has shown occasional weakness, but only within the confines of a lateral channel. There is no fundamental basis for long-term strengthening.

If the price is below the moving average, minor short positions may be considered, targeting 1.1709, based solely on technical grounds. Above the moving average line, long positions remain relevant, with a target of 1.1830 (the upper line of the flat on the daily timeframe), which has already been reached in practice. Now the flat must conclude.

Explanations for Illustrations:

- Linear regression channels help to identify the current trend. If both are pointing in one direction, the trend is currently strong.

- The moving average line (20,0 smoothed) indicates the short-term trend and the direction in which trading should currently be conducted.

- Murray levels – target levels for movements and corrections.

- Volatility levels (red lines) – the probable price channel within which the pair will move over the next 24 hours, based on current volatility figures.

- The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is nearing in the opposite direction.