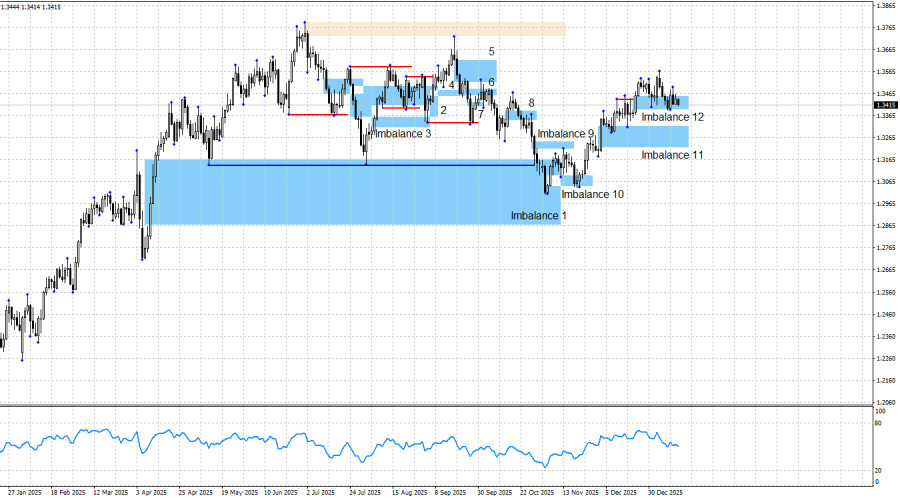

On Thursday, the GBP/USD pair continues to move within Imbalance 12—a pattern that should either see a reaction or be invalidated. The situation is painfully reminiscent of EUR/USD. There is virtually no movement, and traders see no grounds for either long or short positions. As a result, the pound is essentially standing still, reacting not to the news background but to movements in the euro. In the new year, the news flow has already had several opportunities to trigger serious attacks by both bulls and bears. There has been no shortage of events, but for some reason none of them have satisfied traders. Thus, we see no movement, no reaction to patterns, and the bullish trend is on pause.

At the moment, bullish Imbalance 12 remains the only viable pattern. If it is invalidated, this will not lead to an immediate cancellation of the bullish trend. It will only delay the pound's next ascent. This pattern can be considered invalidated below the 1.3356 level.

The current chart picture is as follows. The bullish trend in the pound can be considered complete, but the bullish trend in the euro cannot. Both the euro and the pound can still form new bullish signals within the current trend, but with the market's current level of activity, this will be a challenging task. Donald Trump has once again tripped up the dollar, but traders reacted to it very superficially. Therefore, I continue to expect growth in the British pound, but such growth will occur only if the market begins to work through events, news, and reports.

On Thursday, traders learned that the UK economy grew by 0.3% in November, exceeding market expectations of 0.2%. Industrial production volumes rose by 1.1% in November versus a forecast of 0.1%. In my view, these two reports could have allowed the bulls to launch an attack, but once again we saw nothing of the sort. The euro also ignored GDP reports from Germany and industrial production data from the European Union.

In the United States, the overall news background remains such that nothing other than a long-term decline of the dollar can be expected. The situation in the U.S. remains quite difficult. The shutdown lasted a month and a half, and Democrats and Republicans have agreed on funding only through the end of January, which is just three weeks away. U.S. labor market statistics continue to disappoint. The last three FOMC meetings ended with dovish decisions, and the latest data suggest that the pause in monetary easing will be short-lived. Trump's military aggression, threats toward Denmark, Mexico, Cuba, and Colombia, as well as the initiation of criminal proceedings against Jerome Powell, perfectly complement the current picture in the U.S. In my view, the bulls have everything they need to begin a new offensive and return to last year's highs.

A bearish trend would require a strong and stable positive news background for the dollar, which is difficult to expect under Donald Trump. Moreover, the U.S. president himself does not need a strong dollar, as the trade balance would remain in deficit in that case. Therefore, I still do not believe in a bearish trend for the pound, despite the fairly strong decline in September and October. Too many risk factors continue to hang like dead weight on the dollar. How are bears supposed to push the pound further down if a bearish trend is supposedly forming right now? If new bearish patterns appear, a potential decline in the pound can be reconsidered, but at the moment there are none.

News Calendar for the U.S. and the United Kingdom:

- United States – Change in industrial production (14:15 UTC)

On January 16, the economic calendar contains one "second-tier" entry. The impact of the news background on market sentiment on Friday will be weak.

GBP/USD Forecast and Trading Advice:

For the pound, the picture remains favorable for traders. Four bullish patterns have been worked out, signals have been formed, and traders can maintain long positions. I see no informational reasons for a strong decline in the pound in the near term.

A resumption of the bullish trend could have been expected as early as the area of Imbalance 1. At this point, the pound has reacted to Imbalance 1, Imbalance 10, Imbalance 11, and Imbalance 12. In the near future, another bullish signal may form within Imbalance 12. As a target for potential growth, I consider the 1.3725 level, but the pound may rise much higher in 2026. The main thing is for trading to finally resume after the New Year holidays. If bearish patterns form, the trading strategy may need to be revised, but at the moment there are no grounds for that.