The GBP/USD pair remained virtually immobile on Tuesday, despite there being a multitude of trading cues for market participants. Late Monday night, it became known that a criminal case had been opened against Jerome Powell regarding excessive and unjustified spending on Fed building renovations, as well as knowingly false statements made to the US Congress. On Tuesday, the US inflation report was released, which, in my view, leaves open the possibility for more aggressive monetary easing in 2026 than the market currently anticipates. However, the policy rate is unlikely to change at the January FOMC meeting, which is supportive of the US dollar. Nevertheless, neither the dollar nor the euro, and neither bulls nor bears, currently have the willingness to move or trade. Market activity is minimal or extremely weak.

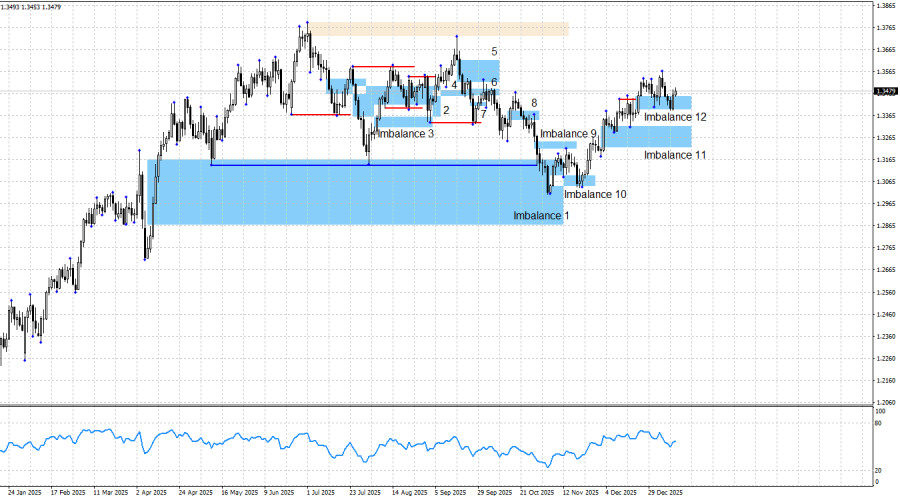

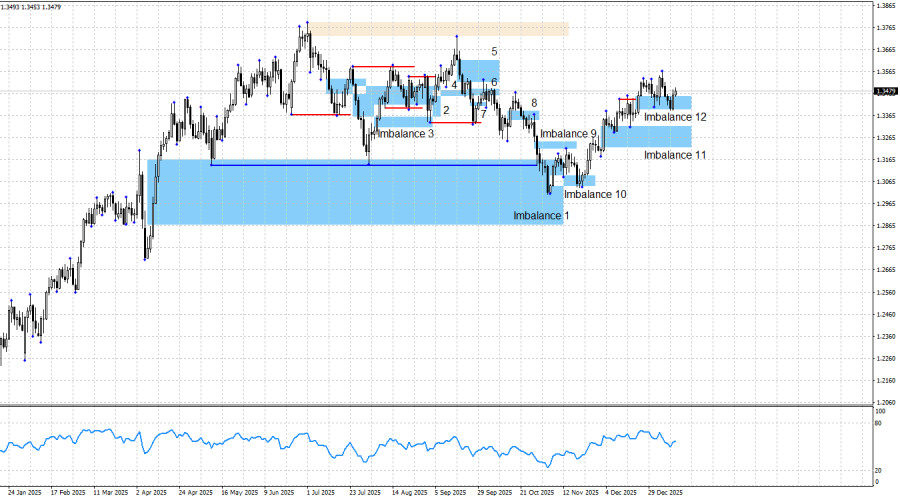

The Bullish Imbalance 12 remains the only viable pattern at the moment. If invalidated, it would not immediately cancel the bullish trend—it would only delay a renewed advance for the pound. However, a new bullish signal could still emerge within this pattern, as I warned last week. Bullish traders had to wait for support from Trump to launch a new advance, but traders themselves must remain proactive. Unfortunately, what we are seeing now is market passivity.

The chart picture is as follows: the bullish trend in GBP may be considered complete, but the bullish trend in EUR is not. Both the euro and the pound could generate new bullish signals in the near term, but given the current weak momentum, this is a challenging task. Donald Trump delivered another setback for the dollar, but traders responded only superficially. Therefore, I still expect the British pound to rise—but this growth will occur only if the market actively processes events, news, and reports.

On Tuesday, traders learned the level of December inflation and were disappointed that there were no changes compared to November. If inflation had accelerated, it could have indicated a more hawkish FOMC stance in early 2026. If inflation had slowed, a rate cut might have been expected as early as late January. The report showed neither scenario.

In the US, the overall information backdrop continues to suggest that nothing long-term is supportive for the dollar. The situation remains complex: the government shutdown lasted one and a half months, and Democrats and Republicans have agreed to fund only through the end of January, which is just three weeks away. US labor market statistics continue to disappoint. The last three FOMC meetings concluded with dovish decisions, and recent data suggest that the pause in monetary easing will not last long. Trump's military aggressions, threats toward Denmark, Mexico, Cuba, and Colombia, and the criminal investigation against Jerome Powell further reinforce the current picture in the US. In my view, bulls have every reason to launch a new advance and restore the pound to last year's peaks.

For a bearish trend to emerge, a strong and stable positive US news backdrop is required—something unlikely under Trump. Moreover, the US president does not want a strong dollar, as it would worsen the trade deficit. Therefore, I still do not believe in a bearish trend for GBP, despite the significant declines in September and October. Too many risk factors weigh on the dollar. How could bears push the pound further down if the current market context does not support a bearish trend? Potential declines could be reconsidered only if new bearish patterns appear—but none exist at present.

US and UK Economic Calendar:

- US – Producer Price Index (13:30 UTC)

- US – Retail Sales Change (13:30 UTC)

- US – Existing Home Sales (13:30 UTC)

On January 14, the economic calendar lists three releases, none of which are considered significant. The news backdrop will have a weak influence on market sentiment, mainly in the second half of the day.

GBP/USD Outlook and Trading Guidance:

The outlook for the pound remains favorable for traders. Four bullish patterns have already been worked through and generated signals, allowing traders to maintain long positions. I see no news-based reasons for a significant decline in GBP in the near term.

Renewal of the bullish trend could have been expected from Imbalance 1. To date, the pound has reacted to Imbalances 1, 10, 11, and 12. Today, another bullish signal may form within Imbalance 12. The potential upward target is 1.3725, though the pound could rise significantly higher in 2026. If bearish patterns emerge, the trading strategy may need adjustment, but at present there is no basis for such changes.