The EUR/USD currency pair maintained a downward trend throughout Wednesday, but most importantly, psychological pressure was lifted from the euro. A day earlier, Germany published its December inflation report, which showed that consumer prices slowed to +1.8% year-on-year, compared to 2.3% the previous month. We said at the time that it was too early to panic and that it would be better to wait for the inflation report for the entire European Union. Yesterday, the corresponding report was released, and its figure exactly matched forecasts at 2%.

Why is a slowdown in inflation dangerous for the euro? It's quite simple. If inflation continues to fall below the 2% level, this gives the ECB a reason to resume a monetary easing cycle. Recall that earlier some members of the ECB's Monetary Committee had suggested that in 2026 the regulator might raise key interest rates once or several times. If inflation falls below the ECB's target level, there can be no talk of policy tightening. It was precisely this logical chain that prompted the market to sell the euro on Tuesday. However, as it turned out on Wednesday, the alarm was false: inflation in the EU remains exactly at the target level.

Thus, for the EUR/USD pair, data on the U.S. labor market, unemployment, and inflation continue to be the top priority. These figures will determine the Federal Reserve's future monetary policy decisions. Several reports on these indicators were published on Wednesday, but we prefer to draw conclusions based on the Nonfarm Payrolls report and the unemployment rate, which will be released on Friday. Yesterday's ADP, JOLTS, and ISM reports are, of course, important and did trigger a market reaction. However, local reports that do not affect the Fed's monetary policy are unlikely to bring an end to the range-bound movement on the daily timeframe.

Yes, the EUR/USD pair is still trading between the levels of 1.1400 and 1.1830. It has been doing so for six consecutive months. How much longer it will remain in this range is hard to say. The year began quite turbulently, with Trump's military operation in Venezuela. However, as the following few days showed, the market did not appreciate Trump's efforts to seize Venezuela's oil fields under the guise of fighting drug trafficking. The market also does not believe that Trump will conduct similar operations in Cuba, Colombia, or on the island of Greenland, which belongs to Denmark, a member of the European Union.

Thus, Trump's attack turned out to be very spectacular, but further developments may follow the rule "Trump always chickens out." Apparently, the U.S. president hoped to kill two birds with one stone—overthrow the Maduro regime in Venezuela and show the whole world that he should not be trifled with. The first part of the plan was executed with flying colors, while the second so far deserves no more than a "C."

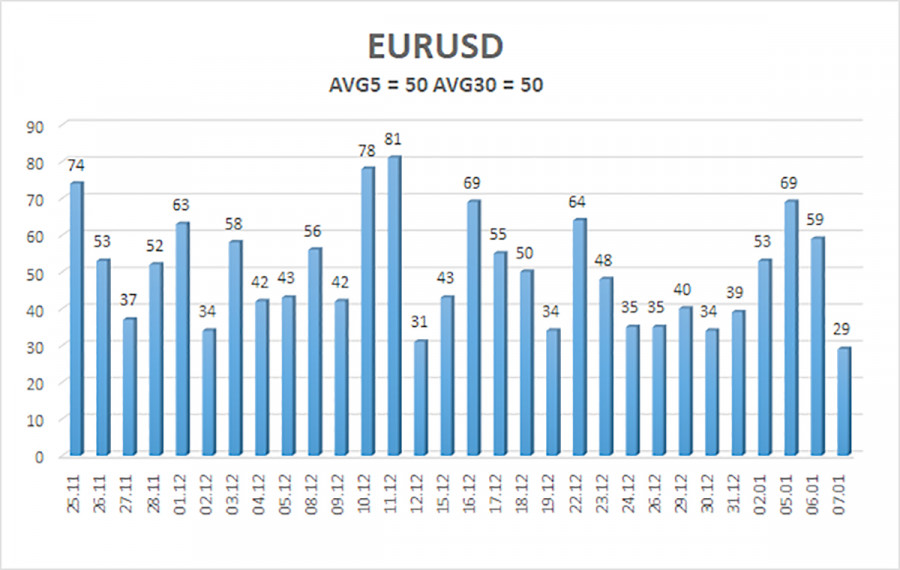

The average volatility of the EUR/USD currency pair over the last five trading days as of January 7 is 50 points and is characterized as "medium-low." We expect the pair to move between the levels of 1.1640 and 1.1740 on Thursday. The senior linear regression channel is directed upward, but in practice, a range-bound market on the daily timeframe continues. The CCI indicator entered the overbought zone in early December, but we have already seen a small pullback. Last week, a bullish divergence was formed, indicating a resumption of the upward trend.

Nearest support levels:

S1 – 1.1658S2 – 1.1597S3 – 1.1536

Nearest resistance levels:

R1 – 1.1719R2 – 1.1780R3 – 1.1841

Trading Recommendations:

The EUR/USD pair remains below the moving average, but an upward trend persists on all higher timeframes, while a range has continued on the daily timeframe for the sixth consecutive month. The global fundamental background remains extremely important for the market, and it is still negative for the dollar. Over the past six months, the dollar has occasionally shown weak growth, but exclusively within a sideways channel. There is no fundamental basis for its long-term strengthening. When the price is below the moving average, small short positions can be considered with targets at 1.1658 and 1.1640 purely on technical grounds. Above the moving average line, long positions remain relevant with a target of 1.1830 (the upper boundary of the daily range), which has in fact already been reached. Now, the range needs to come to an end.

Explanation of the Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is currently strong.

- The moving average line (settings: 20,0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) indicate the probable price channel in which the pair will trade over the next 24 hours, based on current volatility readings.

- The CCI indicator: entering the oversold zone (below -250) or the overbought zone (above +250) signals that a trend reversal in the opposite direction is approaching.