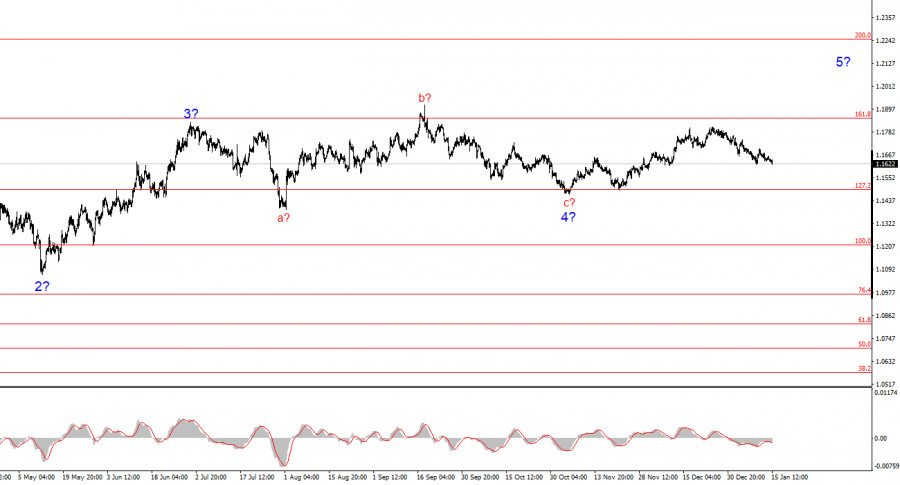

The wave count on the 4-hour chart for EUR/USD remains unchanged. There is no talk of canceling the upward segment of the trend that began in January of last year, but the wave structure starting from July 1, 2025 has taken on an extended corrective form. In my view, the pair has completed the construction of corrective wave 4, which has a non-standard internal structure. Within this wave, we observed exclusively corrective structures, so there is no doubt about the corrective nature of this wave.

In my opinion, the construction of the upward segment of the trend has not been completed, and its targets extend as far as the 25th figure. In the coming weeks, one can expect a continuation of the upward wave sequence, which may take on a five-wave form. However, there is no confidence that an impulsive segment of the trend is currently being formed, so the entire upward wave sequence may end after three waves. In that case, the construction of a new downward segment has already begun—also corrective in nature.

During Thursday, the EUR/USD pair fell by about 20 basis points by the start of the U.S. session, and the amplitude of movements was again minimal. The news background today could have supported both buyers and sellers, yet we continue to observe inert, momentum-driven downward movement. It is extremely difficult for me to say what exactly is behind the daily decline of the European currency, especially given that today the economic backdrop in the European Union was fairly strong. If Germany's GDP for 2025 neither impressed nor disappointed, industrial production in the EU rose by 2.5% year-on-year, exceeding market expectations. However, the industrial production report did not save the euro from losing another 20–30 points.

As for U.S. statistics, by the time the instrument fell by another oft-mentioned 20 points, not a single report had yet been released in the United States. Overnight, Donald Trump stated that in the near future U.S. military forces would not attack Iranian government and military facilities, as "information was received that Iranian authorities have abandoned the executions of demonstrators and protesters." However, the U.S. president promised to keep his finger on the pulse of the Iranian regime change. If the geopolitical situation in the Middle East had softened, the market should have responded by reducing demand for the U.S. currency. Instead, we are seeing the opposite movement—almost every day.

Based on all of the above, I conclude that at the moment, with a high degree of probability, the market has begun forming another corrective wave sequence within the presumed global wave 4. In the near term, one can rely only on the wave count, even though it is quite complex and heterogeneous.

Overall conclusions

Based on the EUR/USD analysis, I conclude that the instrument continues to build an upward trend segment. Donald Trump's policies and the Federal Reserve's monetary policy remain significant factors behind the long-term decline of the U.S. dollar. The targets of the current trend segment may extend as far as the 25th level. However, to reach these targets, the market must complete the formation of an extended wave 4. At present, we see only the market's intention to continue this wave. Therefore, in the near future, a decline toward the 15th level can be expected.

On a smaller scale, the entire upward trend segment is visible. The wave count is not the most standard, as corrective waves differ in size. For example, the higher-degree wave 2 is smaller than the internal wave 2 within wave 3. However, this also happens. Let me remind you that it is best to identify clear and understandable structures on charts rather than strictly tying everything to every individual wave. At present, the upward structure raises no doubts.

The main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often signal changes.

- If there is no confidence in what is happening in the market, it is better to stay out of it.

- There is no and cannot be 100% certainty about the direction of movement. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.