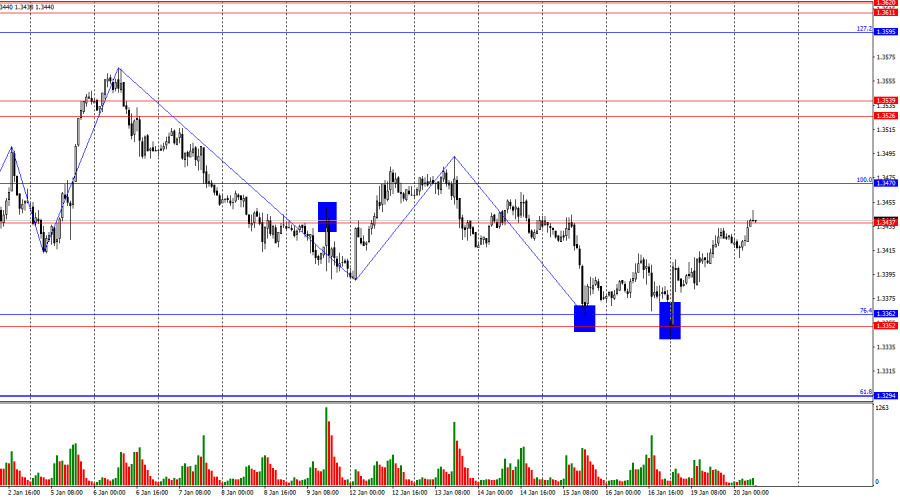

On the hourly chart, the GBP/USD pair on Monday bounced off the support zone at 1.3352–1.3362, reversed in favor of the British pound, and rose to the resistance level at 1.3437–1.3470, near which trading has been taking place for an entire month. A rebound from this zone would work in favor of the U.S. dollar and lead to some decline in the pair toward 1.3352–1.3362. A firm break above the 1.3437–1.3470 level would allow expectations of growth toward the resistance level at 1.3526–1.3539.

The wave situation remains "bearish." The last completed downward wave broke the previous low, while the new upward wave failed to break the previous peak. The news background for the pound has been weak in recent weeks, but the news background in the U.S. has been even worse. Nevertheless, bears have continued to attack in recent days, which raises some questions about the logic behind the strengthening of the U.S. currency.

The news background on Monday allowed bullish traders to wake up. As I have said before, I do not see enough reasons for the U.S. dollar to strengthen in recent weeks. However, yesterday bulls were strongly supported by Donald Trump, who decided to punish EU countries and the United Kingdom for refusing to give up property and territorial rights to Greenland. The island of Greenland belongs to Denmark, and the UK is not even a member of the EU. However, London remains in close cooperation with the EU on geopolitical and territorial integrity issues and has sent several military personnel to protect the island. This is precisely what displeased Donald Trump. As a result, imports of British goods into the U.S. will now be subject to an additional 10% tariff, despite the trade agreement reached last year. Against this backdrop, the U.S. dollar began to lose demand across the market. Thus, no miracle occurred—the market did not ignore the new trade war.

No miracle occurred in the UK either today. Inflation did not fall to 5% as some traders had expected, and the number of new unemployed turned out to be higher than forecasts. It will be difficult for the pound to continue rising without Trump's help.

On the 4-hour chart, the pair has returned to the support level at 1.3369–1.3435. A rebound from this zone would again work in favor of the pound and a resumption of growth toward the next Fibonacci level of 127.2% at 1.3795. A firm break below the 1.3369–1.3435 level would allow traders to expect a reversal in favor of the U.S. dollar and a decline toward the support level at 1.3118–1.3140. No emerging divergences are observed today.

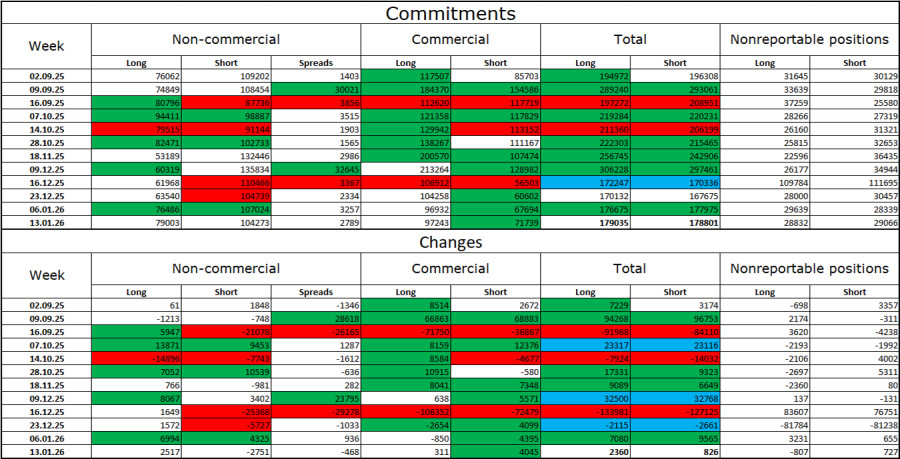

Commitments of Traders (COT) Report:

Sentiment among the "Non-commercial" category of traders became more bullish over the latest reporting week. The number of long positions held by speculators increased by 2,517, while the number of short positions decreased by 2,751. The gap between long and short positions currently stands at approximately 79,000 versus 104,000 and is narrowing rapidly. Bears have dominated in recent months, but the pound appears to have exhausted its downward potential. At the same time, the situation with euro contracts is directly opposite. I still do not believe in a bearish trend for the pound.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency may enjoy occasional demand in the market—but not in the long term. Donald Trump's policies have led to a sharp deterioration in the labor market, forcing the Federal Reserve to ease monetary policy in order to curb rising unemployment and stimulate job creation. U.S. military aggression also does not add optimism for dollar bulls.

Economic Calendar for the U.S. and the UK:

- United Kingdom – Unemployment Rate (07:00 UTC)

- United Kingdom – Average Earnings Change (07:00 UTC)

- United Kingdom – Claimant Count Change (07:00 UTC)

On January 20, the economic calendar contains three events, all of which have already been released. The impact of the news background on market sentiment on Tuesday will be absent.

GBP/USD Forecast and Trading Advice:

Selling the pair is possible today on a rebound from the 1.3437–1.3470 level on the hourly chart, with a target at 1.3352–1.3362. Buying opportunities were available on a rebound from the 1.3352–1.3362 level on the hourly chart, with a target at 1.3437–1.3470. The target has been reached. New buy positions can be considered after a close above the 1.3437–1.3470 level, with a target at 1.3526–1.3539.

Fibonacci grids are drawn from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.